Big Island Solar Power | Grid-Tied & Off-Grid Solar Panels

Off-Grid Solar systems | Grid-tied solar systems | commercial SYSTems

Big Island Solar is locally owned and operated and committed to harnessing the sun to power the islands. It is our mission is to bring the best possible outcomes to the Hawaii. We care about the aina, "the land", and the people of Hawaii. With the traditional use of fossil fuels for electricity- such as gas and coal, toxic gases are released into the atmosphere. Hawaii is geographically in a prime position to harness the power of the sun and Big Island Solar is here to help residents do just that.

Serving the Big Island Of Hawaii-

Kona, Kohala, Waikoloa, Waimea, Honoka'a

Kona, Kohala, Waikoloa, Waimea, Honoka'a

Solar Energy SystemsOFF-GRID SOLAR SYSTEMS

|

SOlar Tax CreditsSOLAR INVESTMENT TAX CREDIT (ITC)

The Solar Investment Tax Credit of 26% has been extended in 2021 and 2022. The Federal tax credit will continue to be 26% in 2021 and 26% in 2022. In 2023 it will be reduced to 22% and in 2024 there will be no Federal tax credit for residential systems. A 10% tax credit on commercial systems will remain indefinitely. TAX CREDITS ON BATTERIES As long as batteries are charged by solar, the photovoltaic tax credits can be applied to batter purchases. |

Get A QUotE

We love new projects!

Are you interested in learning the initial cost and and long term savings of a home solar system? There are different options to fit different needs.

Allow us to provide you with more information and a complimentary quote on an off-grid or grid-tied solar PV system for your Big Island home or business.

Allow us to provide you with more information and a complimentary quote on an off-grid or grid-tied solar PV system for your Big Island home or business.

Helping to define Hawaii's Sustainable Future......

With the financial and environmental savings that a Solar Energy System and PV system in Hawaii offers, why not switch over today?

More and more home owners and businesses alike are realizing the long term benefits that energy derived by solar power provides. Being located in the heart of the Pacific Ocean, the Hawaiian Islands have an advantage with the sunlight they receive. As more people are turning to Solar, Solar Panels and technology for homeowners and business's are improving and becoming more cost effective and efficient. Take advantage of this natural gift of light and get more information, and a free no-obligation quote today.

Allow the Solar Process to begin with Big Island Solar Power. Powered by Sunlight.

More and more home owners and businesses alike are realizing the long term benefits that energy derived by solar power provides. Being located in the heart of the Pacific Ocean, the Hawaiian Islands have an advantage with the sunlight they receive. As more people are turning to Solar, Solar Panels and technology for homeowners and business's are improving and becoming more cost effective and efficient. Take advantage of this natural gift of light and get more information, and a free no-obligation quote today.

Allow the Solar Process to begin with Big Island Solar Power. Powered by Sunlight.

Solar Benefits

Solar Energy is a green financial and environmental decision. Learn some of the benefits of Solar Power on the Big Island for Home and Business.

- Energy Costs Reduced. Over 70% of energy on the islands is supplied by fossil fuels. Energy Fuels are non renewable so waste money and the earths atmosphere. A home solar system can reduce your financial costs up to 50%! When you add that cost up throughout the years, that is some serious money. Hawaii residents save about $64,000 the first 20 years...What are your energy bills now?

- Increase Home Value. The National Renewable Energy Laboratory performed a study that came to the conclusion: Homes with Solar Panels sell for 17% more money and 20% faster than those without.

- Tax Incentives. There are both Federal and Local State (Hawaii) Tax incentives. To learn more check out the Federal and State Solar Tax Incentives.

- Going Solar is Simple. Solar Purchase and Lease Options are available. This makes solar attainable for everyone, depending on your needs and your life. Learn more about purchasing Solar for your home versus leasing Solar for your Home.

- Environmental Benefits. Protect Hawaii! Not only is Solar Energy Sustainable, it's renewable! Help reduce your carbon foot print by going Solar. We will eventually run out of fossil fuels (gas, coal and oil). But sunlight will shine on!

HOW DOES SOLAR ENERGY WORK?

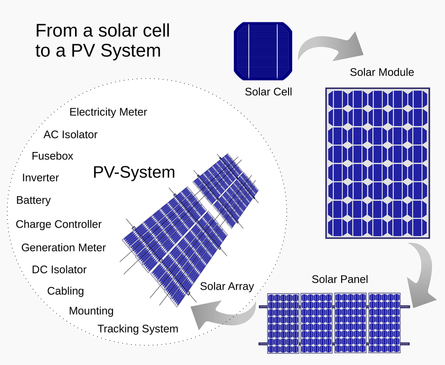

Solar Panels are made up of cells called Solar Photovoltaic Cells (PV). These Solar Cells convert the suns energy, or sunlight, into electricity at the atomic level. This electricity is converted into a direct current (DC) electricity. An inverter, an electrical device converts Direct Electricity (DC) generated by the Hawaii Solar Panels, into an alternating current (AC) electricity. From the inverter, the AC electricity is transferred to your electrical panel, which powers your lights and other electrical items. A Utility Meter Measure the amount on energy your home or business uses. If you are generating more electricity than needed, it can be saved for the evening hours. All of the energy is connected to the grid. Again at night, your day time excess energy is stored to offset your evening energy.

Solar Panels are made up of cells called Solar Photovoltaic Cells (PV). These Solar Cells convert the suns energy, or sunlight, into electricity at the atomic level. This electricity is converted into a direct current (DC) electricity. An inverter, an electrical device converts Direct Electricity (DC) generated by the Hawaii Solar Panels, into an alternating current (AC) electricity. From the inverter, the AC electricity is transferred to your electrical panel, which powers your lights and other electrical items. A Utility Meter Measure the amount on energy your home or business uses. If you are generating more electricity than needed, it can be saved for the evening hours. All of the energy is connected to the grid. Again at night, your day time excess energy is stored to offset your evening energy.

|

Get More Solar Energy Information Today!!

Big Island Solar Power

Big Island Solar Power serves all areas of the Big Island of Hawaii, including Waikoloa, Kona, Waimea, Hilo, Kohala, and all other areas. Contact us for your free Property Solar Quote.